Bitcoin Plunges to Six-Week Low as RiskOff Mood Picks Up

Bitcoin extended this month's losses in Monday's trading as investors moved away from risky assets into a more aggressive outlook on the Federal Reserve's policy tightening.

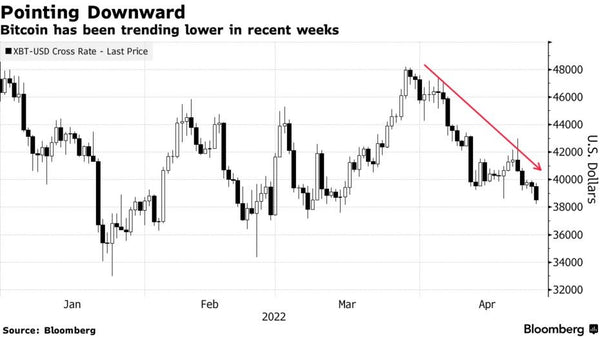

The biggest cryptocurrency fell 3.2% to $38,236, the lowest since March 15, and down more than 20% from last month's high. The second-largest coin, Ether, plunged 4.8% to $2,799, a level not seen since March 18.

Price charts signal that further decline is likely, according to technical analysts. Bitcoin fell below its Ichimoku cloud support on a weekly chart, with secondary support only reaching around $27,200, said Katie Stockton, founder and managing partner of Fairlead Strategies. I don't just see more downsides.

"Bitcoin appears to be breaking a two-month fundamental trend during Friday's pullback, likely returning weakness to January lows," Mark Newton, technical strategist at Fundstrat, wrote in a research note on Friday. He expects an initial pullback to $36,300, “but breaks from that level should lead to a full retest of $32,950 without too much trouble.

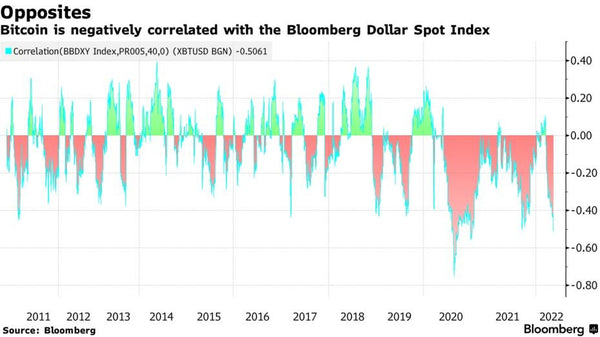

Despite all its recent losses, Bitcoin remains in the middle of a trading range that has held since the start of the year, between around $35,000 and $45,000. The digital currency is moving strongly in line with the tech-heavy Nasdaq 100 and is negatively correlated with the dollar.

As the Fed plans to raise rates by 50 basis points over the next few months to fight inflation, some of the factors that fueled the cryptocurrency's stellar gains over the past two years are reversing.

“As holding dollars becomes more valuable, some investors may reallocate Bitcoin or gold to dollars,” a Nydig team wrote in a report on Friday. “Like the negative correlation between Bitcoin and the dollar, the negative correlation between Bitcoin and real rates has only emerged in the past two years.

Bitcoin can still be primarily driven by basic factors, adore user growth and network usage, however it’s necessary to grasp the evolving macro relationships, they said.